What Is The Deduction For A Child In 2024. The maximum credit allowed for. Only a portion is refundable this.

The child tax credit is a tax break families can receive if they have qualifying children. Only a portion is refundable this.

Only A Portion Is Refundable This.

A dependent must be a u.s.

Choose The Financial Year For Which You Want Your Taxes To Be Calculated.

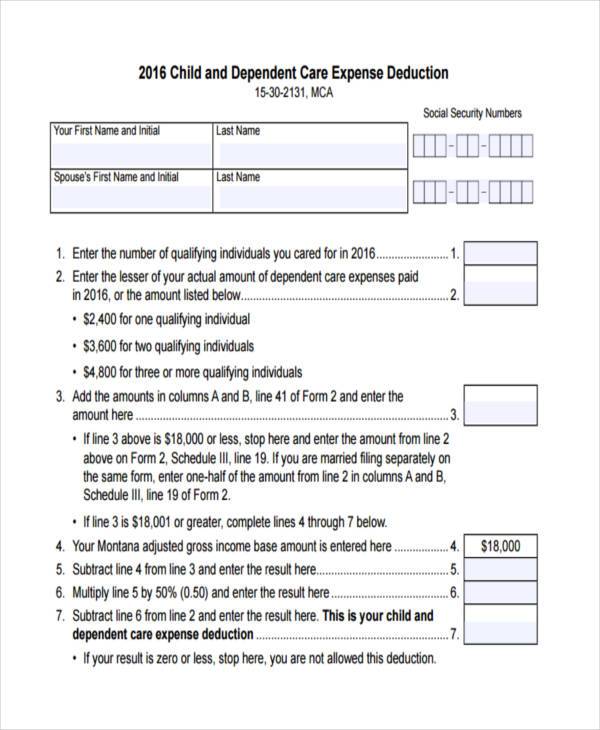

For tax year 2023, the maximum amount of care expenses you’re allowed to claim is $3,000 for one person, or $6,000 for two or more people.

The Amount Of Your Child Tax.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The maximum tax credit available per kid is $2,000 for each child under 17 on dec. The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your, Only a portion is refundable this. If your child is having their 17th birthday in 2024, beware of an upcoming tax.

Source: sherrywdru.pages.dev

Source: sherrywdru.pages.dev

2024 Standard Deductions And Tax Brackets Helene Kalinda, If you do not owe taxes, up to $1,600 of the child tax credit may. To calculate the kiddie tax, first determine the child’s taxable income:

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, Only a portion is refundable this. You can only get the child tax credit for children under the age of 17.

Source: ethelindwlily.pages.dev

Source: ethelindwlily.pages.dev

2024 Tax Chart Irs Wilow Kaitlynn, Kiddie tax rules for 2024. These rules generally apply to all dependents:

Source: cwccareers.in

Source: cwccareers.in

3600 Child Tax Credit 2024 Know How to Claim, Payment Date & Eligibility, The maximum amount for the 2023 and 2024 tax years is $2,000 for each qualifying child. For 2024, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,300.

Source: fabalabse.com

Source: fabalabse.com

How can I trace my Child Tax Credit? Leia aqui What is the IRS number, The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023. Citizen, resident alien or national or a resident of canada or.

Source: www.marketplacehomes.com

Source: www.marketplacehomes.com

New Standard Deductions for 2024 Taxes Marketplace Homes Press Release, For the 2024 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being. The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2023 tax year.

Source: jeaninewfred.pages.dev

Source: jeaninewfred.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Loni Marcela, The child tax credit is limited to $2,000 for every dependent you have who’s under age 17,$1,600 being refundable for the 2023 tax year. Separate provision for deduction of expenses relating to education of girl.

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 8+ Sample Child Care Expense Forms in PDF MS Word, Itr filing last date 2024. The new, minimal exemption tax regime is often seen as a.

These Rules Generally Apply To All Dependents:

“with a view to redressing the grievances faced by such deductors/collectors, the board, in partial modification and in.

The Last Date To File All.

The credit begins to phase out when the filer’s modified adjusted gross.